What If an Uninsured Motorist Hits Me?

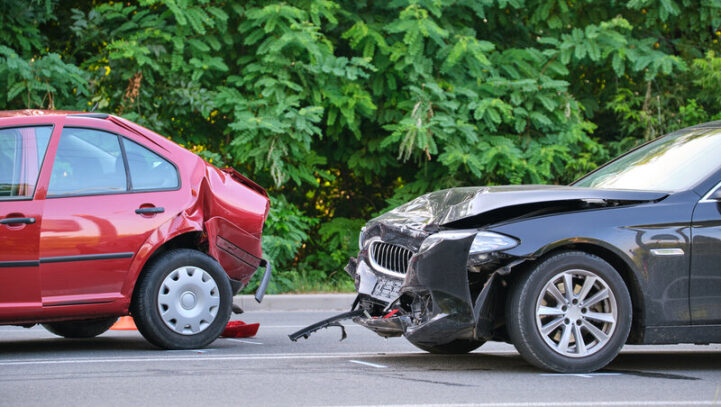

You are driving on I-95 when you are rear-ended by another driver who is required under Florida law anytime a motor vehicle accident results in either property damage or personal injuries or death to pull his car to the side of the road. You also pull your car safely to the side of the road and get out, although it is difficult because you are in so much pain. You grab your insurance card and manage to limp your way over to him. When you ask for his insurance information, he shrugs and tells you he does not have insurance. What do you do next? Are you out of luck even though your back is on fire and your car looks close to totaled?

Despite the initial panic you may have been feeling when you first found out the other driver did not have insurance, all’s not lost for your ability to recover for the injuries you suffered and the damages that you will incur as a result of the uninsured driver’s actions. Rather than suing the motorist that hit you, there are several other avenues to pursue if you have been hit by a driver that either does not have insurance or is underinsured. These include your own insurer if you have uninsured/underinsured (UM) insurance as well as potentially someone else who may have owned the car the individual you were hit by was driving.

Florida’s High Uninsured Motorist Rate

According to statistics from the Florida Department of Highway & Motor Vehicle Safety, the percentage of uninsured motorists in Florida as of July 2023 was 6.28%. This was a little over 1 million of the 16 million registered vehicles in the Sunshine State. However, this may be undercounting the number of drivers who actually do not have insurance that are driving on Florida’s roads, given that it only counts vehicles registered in Florida, but not those that someone may be driving on Florida’s roads that are registered out of state.

Your Own UM Insurance

First, if you carry UM insurance, which is optional in Florida under state law but is a good idea to have for the very reason that the state’s uninsured motorist rate is so high, that would be the first place that you would look. You would file a claim with your carrier and then your carrier would be responsible for paying your damages and the expenses associated with medical treatment you needed as a result of the uninsured driver’s actions.

Other Sources of Insurance

The motorist who hit you may also have been driving someone else’s car. Assuming the motorist that hit you was driving that car with the owner’s consent, you likely could pursue the car’s owner for entrusting his or her car to someone that caused your accident. There are many different scenarios and many different ways to ensure you are made whole for your injuries and damages as a result of someone else’s negligence.

Contact Schwed, Adams & McGinley

At Schwed, Adams & McGinley, our experienced personal injury attorneys have more than 200 years of combined legal experience. Many clients we represent have been injured in accidents involving uninsured motorists. Given the high number of uninsured motorists on Florida’s roads, we have faced the situation many times where a client may have been hit by a motorist who does not have insurance. We know exactly what to do in that situation to maximize the recovery on behalf of our clients. Therefore, if you were the victim of someone else’s negligence in an accident with an uninsured motorist in the Sunshine State, contact our experienced personal injury attorneys today at contact@schwedlaw.com or (877) 694-6079 today.