What If an Uninsured Motorist Hits Me?

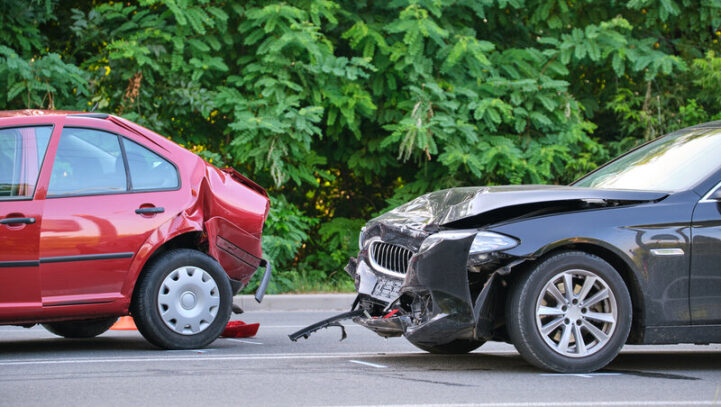

You are driving on I-95 when you are rear-ended by another driver who is required under Florida law anytime a motor vehicle accident results in either property damage or personal injuries or death to pull his car to the side of the road. You also pull your car safely to the side of the road…